-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

Tuopu Group (601689.CH) - High Growth Ratio for Result Continued

Wednesday, June 21, 2023  1799

1799

Tuopu Group(601689)

| Recommendation | Accumulate |

| Price on Recommendation Date | $67.720 |

| Target Price | $73.500 |

Weekly Special - 3306 JNBY Design Limited

Company profile:

Tuopu Group is an industry leader in the field of automotive NVH that is capable of synchronous design with the original equipment manufacturer. In recent years, on the basis of the original business of shock absorbers and interior functional parts, the Company has proactively arranged the module of the lightweight chassis system and the automotive electronics business as the future Ŗ+3" strategic development projects, in order to adapt to the trend of electrification, intellectualization and lightweight of vehicles.

Investment Summary

Strong momentum Continued amid the Pandemic, with impressive growth ratio of 67% for22H2

According to FY2022 Result report, Tuopu 's total revenue for last year was 15.993 billion yuan RMB, a yoy increase of+39.52%. The quarterly revenue was 3.75/3.05/4.31/4.89 billion yuan, with a yoy increase of+54.3%/+22.4%/+48.3%/+34.3% respectively. In terms of net profit, it recorded a net profit attributable to the parent company of 1.7 billion yuan, a yoy increase of 67%, which is basically in line with our previous expectations. From a quarterly perspective, from Q1 to Q4 in 2022, net profit attributable to the parent company was RMB 386/322/501/491 million, with yoy growth rates of+56.8%/+50.7%/+70.6%/+86.2% respectively. The growth momentum mainly comes from the significant increase in sales of the core customers and the expansion of the Company's pipeline.

It is worth mentioning that the result in the second half of the year was impressive, with growth on a mom/yoy (+40%/+77.8%) reaching a new historical high. This was mainly due to factors such as strong customer sales, raw material prices falling, and continuous expansion of the pipeline.

From a segment perspective: The revenue from interior functional components reached 5.463 billion yuan, a yoy increase of+52.7%; The revenue from forging aluminum control arms reached 4.445 billion yuan, a yoy increase of+69.4%; Rubber shock absorption products reported revenue of 3.872 billion yuan, a yoy increase of 15.7%; The revenue of thermal management products reached 1.369 billion yuan, a yoy increase of+6.5%; Automotive electronics achieved revenue of 192 million yuan, a yoy increase of+4.9%. The annual sales Gross margin was 21.61%,+1.73 pct yoy; The net profit margin on sales was 10.62%, with a yoy increase of 1.74 pct. The profitability has steadily improved.

A forward-looking layout has been made in new energy vehicles (NEVs). Especially, Tuopu Group's lightweight chassis and electronic business entered the harvesting period in 2022 and began to contribute to business performance. The year 2022 witnessed the global delivery of 1.31 million units of NEVs by the Group's largest customer, Tesla, up 40%yoy. Tesla's output was 1.37 million units, up 47% yoy. Additionally, the annual sales of new customers--NIO, AITO, Li Auto, and BYD-- up 34%,626%, 47%, and 153% yoy, respectively. The sales growth of both new and existing customers stimulated the Group's growth in revenue and profit. Meanwhile, thanks to the continuous practice of the Tier0.5 business model, the Group's matching amount of single vehicles increased constantly. The net profit margins in 2022Q1-Q4 were 9.56%, 9.65%, 10.98%, and 11.87%, respectively, indicating increasing profitability. The scale effect will hopefully promise continuous profitability growth.

23Q1 saw steady growth, up 17%

In the first quarter of 2023, the Company recorded a revenue of 4.47 billion yuan,+19.3% yoy, and a net profit attributable to the parent company of 450 million yuan, a yoy increase of 16.7%. Gross margin improved+1.1 pct yoy,+2.0 pct qoq, recording 21.9%,. The expense rate has slightly increased: the sales expense rate, administration expense rate, R&D rate, and financial expense rate are 1.16%, 2.68%, 4.76%, and 1.51% respectively, with a yoy increase of -0.20pct,+0.22pct,+0.70pct, and+1.46pct, respectively. The increase in R&D rate is due to the Company's continuous increase in R&D innovation and increased R&D investment; The increase in financial expense ratio is due to an increase in interest expenses and a decrease in exchange earnings.

Private Placement and Capacity Expansion Demonstrate Confidence in Future Order Growth

In order to adapt to the new energy and intelligent trends, expand capacity, and ensure the ability to take orders, the Group has recently released its private placement plan. It intends to raise no more than RMB4 billion by issuing shares no higher than 30% of the total share capital before the issue (i.e. no more than 330 million shares). The funds to be raised will mainly be invested in lightweight chassis, functional interior trims, heat management systems, and intelligent drive projects. The construction period will last 18-30 months. As at 2022Q3, the Group's capacity included 3 million chassis, 5 million functional interior trims, and 500 thousand heat management systems. Comparatively, the private placement plan will increase chassis, functional interior trims, and heat management systems by 6.1 million (+203%), 3.1 million (+62%), and 1.3 million (+260%), respectively. It is estimated that the plan will contribute annual revenue of RMB12.95 billion and net profit of RMB1.31 billion to the Group, after the designed capacity is reached. In short, private placement can strengthen the Group's capacity, long-term profitability, and comprehensive competitiveness. Previously, Tuopu Group raised RMB14.25 billion in total through private placement and the issue of convertible bonds in February 2021 and July 2022 to expand the lightweight chassis project. The ambitious capacity expansion plan demonstrates the Group's confidence in its future business development momentum and rapid order growth. In terms of overseas markets, the Group's plant in Poland has begun mass production and their counterparts in Mexico and the U.S. are being promoted, backing the global business expansion. Tuopu Group has been regarded, by FAW, Geely, Seres, HYCAN, and HiPhi, as their designated supplier of intelligent brake systems (IBS), electric power steering (EPS), air suspension, and heat management projects, according to the Group's announcements. As at the end of 2022, the Group obtained 16 new designated EPS projects (mass production expected to begin from 2022Q4 successively) and seven new designated air suspension projects (mass production expected to begin from 2023Q3 successively). Thanks to the scale effects brought by the fast increase in new customers and products, further profitability growth is promising.

Investment Thesis

The mid- and long-term development of the Group is secured by its deep bond with new energy customers (wherein the income from Tesla accounts for nearly half of the total revenue), constant implementations of new business orders, growing single-vehicle value, rapid capacity expansion, and increasing scale effects.

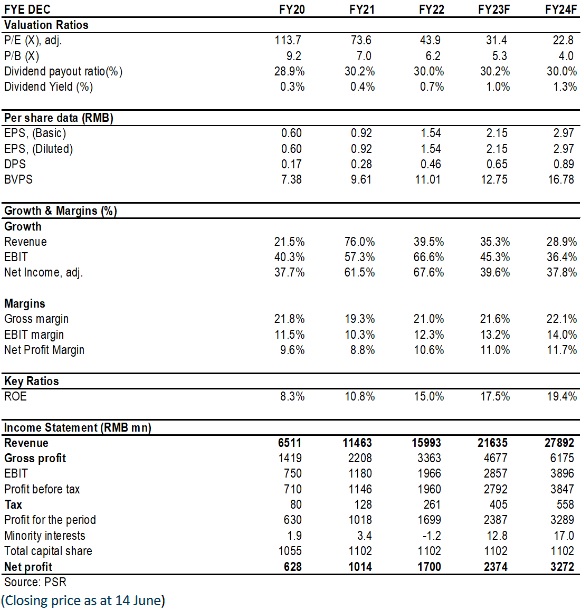

In terms of valuation, we expect the EPS to be 2.15/2.97 yuan in 2023/2024. We are optimistic about the development prospects of the company's lightweight business and automotive electronics. So, we lift the Company's target price to RMB 73.5 yuan, respectively 34/25 x P/E for 2023/2024, a "Accumulate" rating. (Closing price as at 14 June)

Risk

Price war among peers

Raw material price increase

New business risk

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|