-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Market Brief

The articles are produced in Chinese only.

EC HEALTHCARE (2138)

Thursday, December 15, 2022  5517

5517

Commentary:

|

Stock: |

EC Healthcare |

|

1 Month H/L: |

4.71 – 8.18 |

|

Stock Code: |

2138.HK |

|

52 week H/L: |

3.95 – 11.356 |

|

Market Cap.: |

HKD 9.119B |

|

Listing date: |

11/03/2016 |

|

Stock Outstanding: |

1,181,230,189 shares |

|

Listing price: |

3.03 |

|

P/E (TTM): |

45.146 |

|

Chairman & CEO: |

Mr. Tang Chi Fai |

|

Dividend: |

0.10 (mid-term & end of year) |

|

Major Shareholdes: |

1. Tang Chi Fai – 61.29% |

|

Dividend Yield: |

1.295% |

|

|

2. OrbiMed Advisors III Ltd– 5.66% |

|

|

|

|

|

|

Established in 2005, the company was one of the well-known aesthetic medical service provider in Hong Kong. Operating under the brand name, DR REBORN, the brand developed into one of the popular aesthetic medical provider in Hong Kong. Building on their success of DR REBORN, the company began to diversify into medical, dental as well as other medical services. After series of acquisition and consolidation, the company's services are now composed of the following: Medical services, Aesthetic medical and beauty and welless services and Others. As at 30 September 2022, the company operated 154 services points in Hong Kong, Macau and Mainland China.

The company released its 2022 interim result (year ended on 30th September) on the 24th of November, the table below briefly summarised the company's performance:

|

Business segment |

Business description |

Remarks |

|

Medical |

Provide general practice, specialist services such as Orthopedic, dental services, eye care services, oncology , screening services and other medical specialist services. |

Revenue from this segement up 47.5% ,from HK$ 796M to HK$1,174.8M. However, the net profit of this segment showed 48.6% decline, from HK$119.7M down to HK$61.6M. This segment contributed 62.1% of the total revenue. |

|

Aesthetic medical and beauty and wellness |

Operate under various brand names, one of the most well-known is DR REBORN. |

Revenue from this segement down 2% ,from HK$ 619.7M to HK$607.4M. The net profit of this segment dropped 32.2%, from HK$94.5M down to HK$64.1M. This segment contributed 32.1% of the total revenue.

|

|

Others |

This services include: Veterinary care |

Revenue from this segement up 301.9% ,from HK$ 27.6M to HK$110.99M. The increase can be attributed to the newly acquired veterinary business. The net profit of this segment increased significantly from overloss HK$0.581M to HK$19.6M. This segment contributed 5.8% of the total revenue. |

Source: Company's annual reports and interim reports

Overall, the company's revenue was up 31.1% y-o-y to HK$1,893.2 M. However, EBITDA was down 16.6% y-o-y to HK$269.9M and the net profit was down 46.3% y-o-y to HK$105.2M. The decline could be contributed to the challenging condition including uncertainity in the global economy, indefinite re-opening time of the border and weak retail data due to persisting COVID-19. In terms of geograhic contribution, Hong Kong reported revenue HK$1,746.5M, up 33.2% y-o-y and representing approximately 92.3% of the group's overall revenue, while Macau reported revenue HK$ 56.8M, up 7.7% y-o-y and Mainland China had HK$ 89.8M, up 12.6% y-o-y.

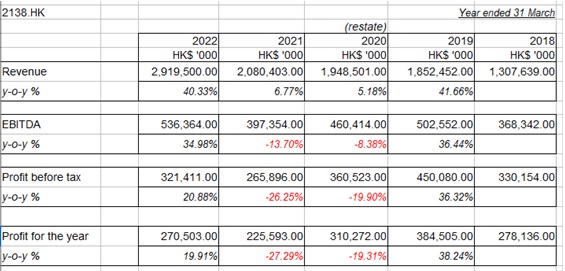

Overall financial summry of the company from 2018 to 2022:

Source: Company's annual reports

Companies comparison (14/12/2022)

|

Stock Code & Company name |

Market captialisation (HK$ Million) |

P/E |

Dividend yield (%) |

|

2138.HK EC healthcare |

9,119 |

45.15x |

1.30 |

|

1830.HK Perfect medical |

5,133 |

16.45x |

4.93 |

|

722.HK UMP healthcare |

634 |

8.565x |

5.63 |

|

1419.HK Human health |

759 |

2.02x |

15.0 |

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|