-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

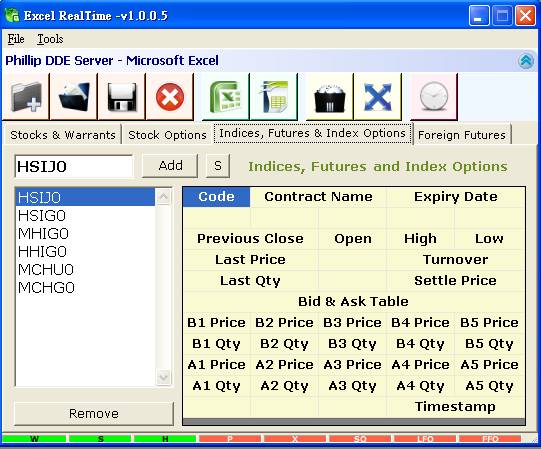

Excel RealTime

"Investment Opportunities Abound"

Excel RealTime ,based on DDE technology, provide 24 hours real-time data, such as HK Stock, Futures, Options and Foreign Futures. Excel RealTime is compatible with Microsoft® Excel or OpenOffice and able to have your own trading platform to conduct technical analysis.

We are not only providing real-time data, also giving a unique program trading system. The trading order can be done while the formula set via Excel RealTime.

Excel RealTime offers an advance technical service to our customer is singular trading platform providing an excellent indicator and technical analysis. All these features are available the key in the product as below:

- Warrants, Options, ELI...etc

- Delta, Gamma and Theta calculation

- Gearing rate

- Your personal design for the future bid/ask

- Excel RealTime is only for Phillip Securities (HK) Limited & Phillip Commodities (HK) Limited client

- User with knowledge of Microsoft Excel/ VBA is a advantage

- Excel RealTime is suitable for MicrosoftR Excel 1997-2007 version

例子I

- 引申波幅與風險數據 Delta、Gamma、theta、Vega 計算

- 認股證與期權的即市引申波幅 Implied Volatility IV 計算/比較

引申波幅Implied Volatility IV是評估認股證或期權價格的最重要因素。一般投資者明白引申波幅須根據正股價格計算,但實戰上須考慮正股以至認股證買賣差價的影響,引申波幅的計算才有參考價值。

圖中見正股買入價(紅色)及賣出價(黃色),認股證或期權買賣價格的在紅色範圍根據正股買入價計算。反之,認股證或期權買賣價格的在黃色範圍根據正股賣出價計算。這樣才有合理的認股證與期權的引申波幅計算及比較。灰色的部份是風險數據Delta、Gamma、theta、Vega計算。

例子II

- 恆生及國企現貨指數的成交價、買入價、賣出價及加權價

- 恆生及國企現貨與期貨指數對比

市面一般即市報價系統只能每15秒更新現貨指數。在實戰上,這少少分別對買賣指數期貨或指數認股證投資者可以影響很大。透過即市更新成份股票最後成交價,便可計算即市現貨指數,與大市同步。尤其當期貨開市而現貨尚在競價時段,更可透過成份股票的競價估計現貨指數開市價,盡佔先機。

圖中淡綠色範圍見成份股最後成交價、買入價、賣出價及加權價。現貨指數只是根據最後成交價計算,但往往未能如成份股般反映買入價及賣出價。實戰上應考慮以成份股買入價計算參考指數,因為這是現貨指數初步的支持。(市價沽貨只能以買入價成交)反之,以成份股賣出價計算的參考指數是現貨指數的初步阻力。(市價掃貨只能以賣出價成交) 圖中紫色範圍見恆生指數及國企指數的現價、買入價、賣出價及加權價。

圖中恆生指數及國企指數的現價、買入價、賣出價及加權價與期貨直接比較,高水低水強勢弱勢一目了然。

例子III

市面一般即市報價系統只能以特定版面報價。Excel RealTime 不單可以於 Excel 建立自己獨特的期權報價系統,同時亦可以計算期權的引伸波幅及風險參數。

圖中上方是期指報價,下方便是同月份的期灌報價,左下方是 (CALL) 認購期權,右下方是(PUT) 認沽期權。

引申波幅Implied Volatility IV是評估認股證或期權價格的最重要因素。

以 14400 (CALL)認購期權為例,買入賣出價為 92 及 95 ,以 92 點的引伸波幅便為 0.108,95點的引伸波幅便為 0.110,投資者可以快速看到引伸波幅差價。在實戰上,投資者可跟據各期權風險參數,如 Deta, Gamma 作組合投資、動態對沖、以至風險管理...等等。

常用字表

- 引申波幅Implied Volatility

- 波幅是評估認股證或期權價格最重要的因素。歷史波幅根據正股價格歷史數據計算出來而引伸波幅從認股證或期權價格本身配合其他客觀影響因素如正股價格、行使價、時間值、 利率及派息計算出來。中國移動的波幅明顯比中電控股高,所以其認股證或期權引伸波幅亦較高。

- Delta

- 當正股價格變動時對期權價格的影響。若 delta=0.5 就表示當正股價格變動1元時,期權價格會跟著變動 0.5元。

- Gamma

- Delta 數值隨正股價格變動。Gamma是用來衡量 delta 的敏感度。Gamma=0.1就表示當正股價格變動1元時,delta跟著變動 0.1。

- Theta

- 認股證或期權每日的價值耗損。假設正股價格及引伸波幅不變,Theta=0.01就表示明日認股證或期權下跌0.01元。

- Vega

- 引伸波幅變動1%時對認股證或期權價格的影響。

- 成份股加權價

- 根據最佳買入賣出價的數量按比例計算中位數

買入價x賣出數量+賣出價x買入數量 買入數量+賣出數量 - 指數加權價

- 根據成份股加權價計算,而現貨指數則根據最後成交價計算。

Disclaimer:

Trading on an electronic trading system will expose you to risks associated with the system including failure of hardware and software. The result of any system failure may be that your order is either not executed according to your instructions or is not executed at all. Phillip Securities (Hong Kong) Limited accepts no responsibility for any loss which may incur by you as a result of unpredictable traffic congestion and other reasons. You should not trade on an electronic trading system if you are not prepared to accept the associated risks.

Top of Page

|

Please contact your account executive or call us now. Excel Realtime Tel : (852) 2277 6730 (24Hr) Email : excelrt@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|